Flare Gas Guide

Flare Gas Mining as an Emissions and Cheap Energy Solution

“MinerBeast marries Bitcoin miners with low-cost power sources to eliminate emissions and monetize excess energy. Flare gas mining is a prime example of a win-win for the environment and business.”

Frank Eakin, President, MinerBeast

Flare gas mining’s moment has arrived. More than ever, profitable Bitcoin mining depends on cheap energy as miners continue an intense worldwide search for low-cost power from Texas to Turkistan. The use of stranded natural gas at oil production sites where gas is flared (“flare gas”) has been receiving more and more focus due to its sustainably lower cost relative to grid electricity, and because crypto mining provides a unique solution to drill-site carbon emissions.

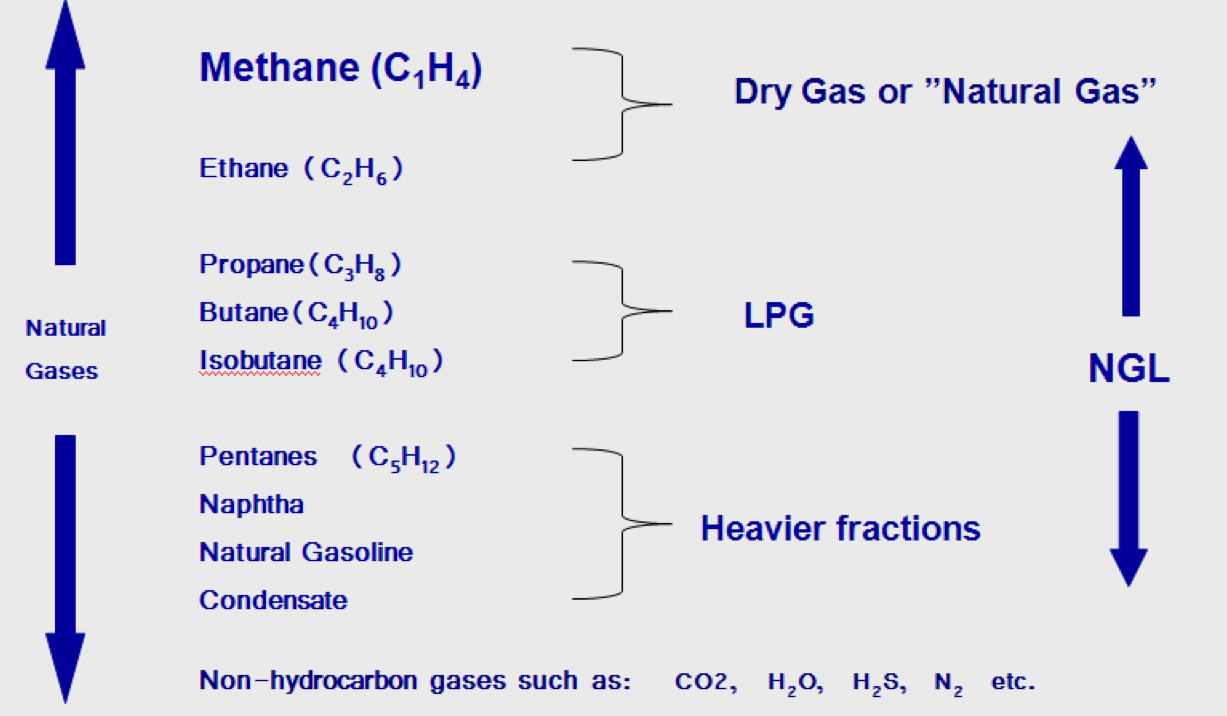

To understand the economics of flare gas as an energy source, it’s useful to know that in oil production, not all hydrocarbons are created equal. Crude oil, which is used to make gasoline and other products, is the most valuable resource and easiest to capture.

In contrast, natural gas (“nat gas”), which is often a by-product of crude oil operations, is in many cases a hindrance to the more profitable crude oil production. The saying in the oilfield is “oil is king, gas is trash”.

To effectively capture nat gas and transport it for sale to markets thousands of miles away, an expensive midstream pipeline or gathering system is required, which may also include natural gas processing facilities and compressor stations (see the gas systems diagram below)

Gas which cannot be gathered by a pipeline (and is stranded) at oil production sites during crude oil pumping, has historically been worthless to oil companies; the stranded gas is normally combusted on-site by flaring and is a cost of production. Things are changing, though. The major oil companies are now actively letting the industry know that flaring is no longer sustainable due to environmental considerations.

Mining as an Ideal Emissions Solution

When there is no pipeline located in the vicinity of an oil production site, the gas must be burned with the use of a flare rather than released directly into the air to reduce harm to the environment. Natural gas is primarily made of methane, an extremely damaging greenhouse gas (GHG) with a Global Warming Potential (GWP) exponentially greater than CO2, and when flared, not all of the gas is combusted. Between 2% to 10% of methane escapes into the atmosphere and contributes to climate disruption.

Land-based oil production sites represent a large contributor to methane emissions, and oil companies, such as Exxon, are now driving the industry to reduce emissions at drill sites due to shareholder pressures and growing liability risks. In addition, the Bureau of Land Management (BLM) has begun imposing strict time and volume limits on flaring and fines for companies that don’t comply.

The good news is that Bitcoin mining offers a proven solution to flare gas emissions by using stranded gas to power containerized data centers at oil production sites. Miners employing a flare gas model featuring cheap energy and emissions reduction, with Oil & Gas (O&G) companies as mining clients who require their expertise, should thrive long term; they will produce outsize profits when Bitcoin currency prices are high and survive deep corrections when Bitcoin is at its lows. Note that while we primarily address Bitcoin mining on MinerBeast, the mining of other Proof-of-Work cryptocurrencies also applies.

How big is the opportunity? According to the Texas Railroad Commission the amount of natural gas flared in Texas alone was over 5 billion cubic feet in 2021, much of which occured in the Permian Basin. Using the enormous amounts of wasted gas as a fuel source, stranded gas miners are in essence converting an operator’s flaring expense into a profit center, and eliminating a colossal source of carbon emissions. It’s a win-win for the miner, oil company and environment.

Production Site

Flare Gas

Electricity Generation

Bitcoin Mining Containers

Bitcoin

Want to learn the fundamentals of the natural gas industry?

View Enerdynamics information on key components of gas operations system.

Finding a Flare Gas Well Site

Your goal in finding an oil production site with a flare gas opportunity will be to negotiate and execute a MSA (Master Service Agreement) for a surface lease of part of the property. Bitcoin miners would in most cases be seeking an agreement with the oil company operating on the site (the “operator”), who in turn will have agreements with the owners of surface and mineral rights. Depending on the location, air permits and noise pollution should be addressed as well.

Finding good well site targets and identifying their operators may be easier than you think. Your options include conducting well site research with a highly sophisticated energy research platform (Enverus), DIY research with information from the government (such as the Railroad Commission and county courthouses), and/or the assistance of a landman.

Enverus: Over $1 billion was spent developing this remarkable energy-dedicated SaaS platform, which provides real-time access to detailed rig data across specific geographies, including flare-related information. Enverus provides map-based title research, contract terms, permits, production records and analytics, and allows you to zoom in to sites.

Once you’ve narrowed your search and decided to reach out to the operator, you’ll find contact information as well.

Government Sources: State governments may have free search tools which you can access online. For example, the Texas Railroad Commission has information and well site maps available for download.

If you are conducting your own research and need to identify the titleholder of a property, the county courthouse will be a starting point. You’ll need to read the legal documents (which can be complicated) which go back to the 1800s when land was granted, and follow title ownership to the present. Usually, the surface property is owned by one person, but in some places such as west Texas, the property is often owned by the government (General Land Office of Texas).

Landman: A landman can create a map of a particular area that will identify prospective sites, and provide contact information for the property’s owners and operator, and other key details. Their experience and relationships in the O&G industry and knowledge of geology, finance, accounting, regulations and law, can help you to negotiate deals with oil companies and land owners.

Approaching the Operator

Once a target flare gas well site has been identified and contact information for the site operator (oil company) has been located, the focus shifts to winning over the operator. If you are the one establishing contact, come equipped with knowledge of the site. Focus on your ability to help the operator by implementing a profitable alternative to flaring.

It is the start of the relationship and your odds of success will increase significantly if you take the approach that you are there to serve the operator. Your Bitcoin mining solution will reduce the operator’s expenses (operating costs and penalties for flaring), increase their revenue (you will pay for their gas and create a new revenue stream), and cut environmental liability risks. Make yourself indispensable.

And this is important – remember that there is no such thing as free gas. Even if gas is offered for free, when the next miner arrives offering to pay for the product there will be no incentive for the operator to continue working with you. However, the nat gas should be inexpensive relative to other energy alternatives so that you become a low-cost miner of Bitcoin with an advantageous breakeven cost.

The operator will want to understand the type of equipment you will locate on the site, use of the operator’s equipment, number of people who will be working on site, potential liability issues, etc., and general liability insurance will be required.

Begin with a pilot project to validate your proposition. When the operator realizes the program is successful, you can likely secure an AFE (Authorization for Expenditure) to expand operations as you demonstrate your ability to provide a benefit to the operator.

To summarize, addressing the operator’s needs, speaking their language, demonstrating how the addition of a mining operation will improve their bottom line, and addressing the growing environmental pressures they are facing, will help to open doors. Some O&G operators may be averse to testing Bitcoin mining because they may not perceive it as part of their core business, or won’t take the time to understand its benefits. But if you plant a seed now with operators, they may knock on your door later as crypto mining grows as an emissions solution and revenue producer.

Securing an MSA (Master Service Agreement) for the Site

The operator will want to have an MSA executed to avoid ambiguity and protect themselves. The MSA is a legal agreement between the miner and the operator that will establish the working arrangement (terms and conditions) between the two parties.

The MSA should cover the scope of the relationship and will remain in place indefinitely through an auto-renewal process. Subsequent mining operations with the same oil company can be arranged with an amendment or through work orders with the confidence that the legal terms in a MSA are already in effect.

Before executing the MSA, you will want to confirm that the operator has already secured the right of way and surface use rights with the property surface owners, and that their contract with the property owners does not include provisions that could limit your operations (if it does, or if you desire an expansion of rights, you may have to work out an arrangement directly with the property owner). You will probably not have to negotiate with mineral rights owners.

A properly drafted MSA should clearly define:

- Obligations and allocation of risk between the parties

- Indemnities:

-

- “knock for knock” indemnity in which the parties are generally responsible for their own people and property

- “negligence based” indemnity in which fault is central to determining who is responsible for failures and damages

- Warranties provided and remedies available

- Payment terms

- Lien rights

- Insurance requirements

- Consequential damages

- Termination rights

- Choice of law

Gas Analysis

The next step is to determine the flow and type of gas present on the well site. A gas analysis can be conducted to determine the composition and flow rate from the well.

| Analysis | ||

|---|---|---|

| Description | GPM | MOL |

| CO2 | .4810 | |

| C1 (Methane) | 74.2900 | |

| C2 (Ethane) | 3.3380 | 12.4630 |

| C3 (Propane) | 1.8185 | 6.5910 |

| iC4 | .2759 | .8420 |

| nC4 | .6760 | 2.1410 |

| iC5 | .1945 | .5310 |

| nC5 | .1888 | .5200 |

| C6 | .3394 | .7880 |

| nlt | 1.3530 | |

| Total | 6.8311 | 100.000 |

Sweet Gas: The easiest type of gas to use for the mining process is dry sweet gas because it does not contain the corrosive H2S (hydrogen sulfide), which is present in sour gas. These molecules are highly corrosive and will destroy your equipment over time. If you have H2S in your gas, it is considered sour or acid gas.

Clean natural gas has been processed to remove impurities such as sulfur compounds, carbon dioxide, and water vapor. Sweet natural gas, on the other hand, refers to natural gas that contains little to no sulfur compounds, which gives it a sweet taste and smell. While the terms “clean” and “sweet” are related to natural gas quality, they refer to different characteristics of the gas.

If the gas is “dry”, this means that it is overwhelmingly composed of methane (typically greater than 85%) and contains little to no condensates such as propane or butane. On the other hand, “wet” gas contains less methane and more condensates. Often these condensates, or natural gas liquids, may be stripped out downstream at processing facilities and have a higher value than methane alone.

Generators: Sweet gas can be run through a reciprocating generator from manufacturers such as Caterpillar or Waukesha Pearce. Reciprocating generators are prevalent in O&G fields, so it is not difficult to find someone to assist with the regular maintenance required, including changing of spark plugs, maintaining 50/50 oil and coolant, etc…. It is vital to have a dependable unit and maintenance plan to avoid generator downtime.

| Output | Type of Generator | Manufacturer/Model |

|---|---|---|

| < 200mcf/day | Reciprocating | Doosan |

| >200 mcf/day | Reciprocating | Caterpillar or Waukesha Pearce |

If your gas is sour (contains H2S or high levels of CO2) then you will need to pre-treat the gas and a different type of generator is required. We will have more on sour gas in a future edition of MinerBeast.

Rather than purchasing a generator and engine set (“genset”) for hundreds of thousands to $1 million+, a miner can lease a 1 MW genset for a cost equivalent of about 3.5 cents per kWh on a six-year lease, including maintenance (pricing varies by location). Operations and leasing costs per month would be around $25,000 per month, $300,000 per year, and around $1.80 million for the six-year period. By leasing, the miner would not need to have upfront capital for the genset and could use that capital to purchase mining rigs.

More information on top generators for off-grid mining is available here.

Heat Rate: The heat rate determines how much fuel a gas flaring operation will burn, as expressed in MCF (thousand cubic feet). MCF is used as the abbreviation to measure the production of a gas well, in which M refers to the Roman numeral M for 1,000, and CF is used for cubic feet. For example, a gas well producing 100 MCF of gas per day is producing 100,000 cubic feet per day.

With very clean gasses (as determined by the identities and the strength of the gas), an operation will burn about 250 MCF in the generator to produce 1 WM megawatt of electricity to power the mine.

It generally requires more energy to burn wet natural gas than dry natural gas. This is because wet natural gas contains higher levels of impurities, such as water and other liquids, which can reduce its energy content and make it more difficult to combust efficiently. As a result, wet natural gas may require additional processing and treatment before it can be used as a fuel source, which can increase its overall energy requirements.

For gasses with a higher BTU, an operation would burn less natural gas per MW produced. Natural gas with a higher BTU (British Thermal Unit) will burn less gas than natural gas with a lower BTU to produce the same amount of heat. This is because natural gas with a higher BTU contains more energy per unit volume, so less of it is required to generate the same amount of heat as natural gas with a lower BTU.

Pricing: Note that midstream nat gas pricing is typically based on heat rate (mmBTU/Mcf). In a stranded gas scenario in which gas cannot access a pipeline, pricing is based on the volume of gas ($/Mcf), regardless of the heat rate.

Midstream natural gas is typically calculated based on its volume, measured in standard cubic feet (SCF) or metric cubic meters (MCM), and its energy content, measured in British thermal units (BTUs) or megajoules (MJ). The volume of natural gas is often measured using flow meters, while its energy content is determined through a process called gas chromatography. These measurements allow for the accurate determination of the quantity and quality of natural gas being transported and processed through midstream infrastructure, such as pipelines and processing facilities.

Set-up for the Site

To experience a video walkthrough of one of the Verde Mining flare gas operations with owner Paul Cockerham in Midland, Texas, watch the video below. We wish to express our deep appreciation to Paul for his servant leadership and sharing his valuable insights to help the mining community and our environment.

See still images below with descriptions of key components of the mine site, from the pumpjack to the data center container.

Data center container (40 ft): the container is filled with ASIC computers and is cooled with air flow.

Gas Flow Intermittency

One of the challenges for miners in flare gas mining is the intermittency of the gas flow. In order to maximize uptime and ensure the process is beneficial for the O&G operator, the miner’s goal is to keep the flare extinguished at all times by running the gas to the generator.

Due to the shrinkage or expansion of the gas as a result of temperature changes, the amount of gas at different times of year can vary widely. In the winter months, the gas condenses causing the amount of power generated to drop significantly. During the summer, the miner must be able to absorb much larger amounts of power generated from the expanded supply of gas produced. The miner monitors the amount of power available in order to adapt to the changing power needs.

One method for increasing mining capacity to flex with power generation variation during peak power periods, is to have a standard number of ASIC rigs needed to consume power based on an average flow of natural gas to the generator, and have additional rigs (even less efficient ones will suffice) installed to absorb the intermittent peak waves of power so that use of the flare is avoided. Thus, the miner is able to absorb the intermittent load generated above a baseload when the gas supply increases, to ensure the flare stays out consistently. In the colder months, mining uptime can be optimized by contracting for makeup (additional) gas from the operator to supplement the available flare gas.

Data Center Container

The data center container is a critical piece of infrastructure for the site. The ability to customize your container for your particular needs is critical, including for example, the ability to operate in extremely hot temperatures (if you mine in west Texas) and in snow environments (if you mine in places which receive snowfall). Also, high quality, dependable electrical and air flow components are important to reduce downtime.

We will have a deep dive on containers and fabricators in our next MinerBeast edition, so stay tuned.

Network for the Operation

Maintaining uptime and being able to track mechanical and other issues with a digital network is vital. The addition of a CISCO-managed switch in the container allows each port to handle 255 addresses so everything can be connected to a single computing source, such as a raspberry pi, for ease of use and monitoring.

Reliable internet coverage in remote mining areas can be challenging, so it is important to have a dependable source that is able to monitor and communicate with all of your equipment. One recommended network company is Noralta, a Canadian company, which provides automation with an interface suite that monitors the ABB meter and the DSE panel on their network. Cell phone alerts can be sent via text message to advise you of sudden changes in gas levels. Starlink is another option in many places, and it can be used as a backup.

For maintenance of ASICs in the container, it is important to easily pinpoint issues. Color coding ethernet cables can help increase efficiency, as well as installing software programs that allow you to remotely monitor and illuminate equipment so you can efficiently pull malfunctioning machines.

Flare Gas Mine Economics

In some areas, there may be just one midstream company available to purchase nat gas from a field, and the midstream company’s pipelines may not reach a large number wells in the area (thus, causing the gas to be flared by the operators). All things being equal, oil companies prefer to sell their gas to a midstream company if possible. However, depending on the gas market there may not be enough demand for the midstream company to purchase all of the gas produced from a well, which provides an opportunity for the Bitcoin miner.

Sweet gas economics: In the case of flare gas opportunities, as we’ve noted, you should not ask an operator for free gas if you wish to build a sustainable relationship. The price is negotiable, and dependent on how much other miners are offering in your area. In any case, the nat gas should be inexpensive relative to other energy alternatives so you have the opportunity to become a low-cost miner.

Some miners offer a fixed royalty fee per MCU, others revenue-sharing, but operators will likely be more attracted to a fixed fee initially. However, some may prefer to take a risk on the currency to gain exposure to the upside of Bitcoin being mined on site. The terms for royalties or joint revenue sharing can be fairly flexible depending on the company or landowner you approach.

If the miner is competing with a midstream company to purchase gas, they will need to offer more for the sweet gas than the midstream company will pay, and the amount will likely be uneconomic for the miner long term. There may be just one midstream company available to purchase gas from a field, so often there’s a lack of competition. All things being equal, oil companies prefer to sell their gas to a midstream company.

Even if there is a midstream company in the area, there may still be an opportunity for Bitcoin miners. The midstream company’s pipelines may not reach a large number wells in the area, or depending on the gas market there may not be enough demand for the midstream company to purchase all of the gas produced from a well, which would open the door for miners.

Payments to Stakeholders and Suppliers: It is important to keep in mind who needs to be paid first in a flare gas operation. The order in which stakeholders are paid can be negotiated, but the arrangements should be clear and formalized.

If the miner leases a genset, all payments toward the genset and paying off the mining equipment could be prioritized before paying investors, in order to ensure key suppliers are paid to keep the operation running. On the other hand, under a revenue-sharing model in which investment funds are used to acquire equipment and no debt is incurred, there could be an arrangement in which the investors are allowed to first recover their investment (after payment of operational expenses) before a percentage of profits is paid out to other shareholders.

To learn about the economics and capital expenditures required to start a flare gas mining site, read a helpful article at Buycorbomite. In addition to the revenue generated from the Bitcoin mining on the site, there are other potential revenue streams such as selling the auxiliary power and water generated. We will discuss additional revenue streams in future editions of MinerBeast.

Even when margins are tight, it is important to take care of the entire team from the mechanic to the landman to the operator. If you establish a strong relationship and are solving a problem for the operator you will become an invaluable resource and gain new opportunities – 100 MCF projects lead to 1000 MCF projects.

Although mining with flare gas may not be as simple as using grid energy for mining, the energy source can be obtained at a much lower rate. You also are not at the mercy of local, state, and government agencies that could decide to prohibit mining or pull demand response subsidies on which some miners heavily rely. In addition, you are solving a problem for operators. Oil and gas production will be part of the energy landscape for the foreseeable future and Bitcoin mining using flare gas also helps mitigate damage to the environment and creates jobs.

Enerdynamics, the leading industry educator in natural gas and electricity education offers highly specialized online courses on natural gas, production and operations. To gain further knowledge on the industry and a more in-depth understanding of how gas is produced and distributed click here.

Explore online energy learning programs from Enerdynamics

Learn about everything from energy fundamentals to demand response and regulations.